Mercury

Project Overview

Stabilizing a Regulated Fintech Platform Through Governance and Trust Architecture

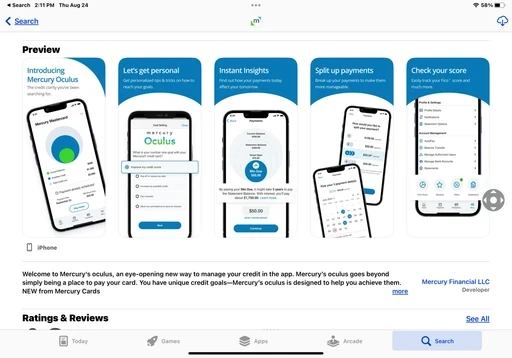

Mercury was a regulated consumer credit fintech undergoing full product re-imagination (“non-banky” positioning for near-prime users). During this critical growth phase, the absence of structured UX governance created delivery instability and diluted user trust.

Objective

Stabilize product definition, formalize UX governance, and redesign high-risk payment flows to restore user control and accelerate platform maturity ahead of merger.

Scope of Work

Platform & Experience Leadership

Led UX across iOS, Android, and Desktop

Redesigned payment, autopay, and split pay flows to increase visible control

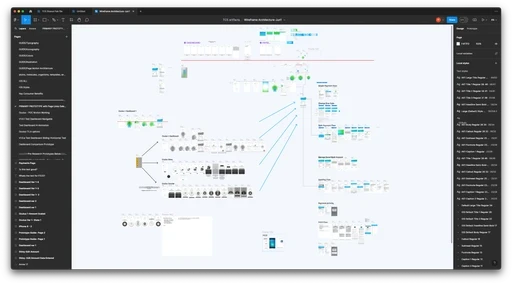

System Architecture & Governance

Built cross-platform design system and governance model

Scaled UX team and aligned creative standards across product

Acceleration & Innovation

Partnered with Tata Creative Services to standardize system delivery

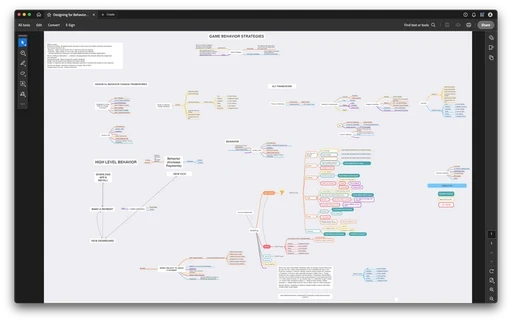

Initiated ML-driven behavioral prompt framework

Engaged Projekt202 to conduct parallel feasibility and usability validation, accelerating insight generation while maintaining delivery momentum

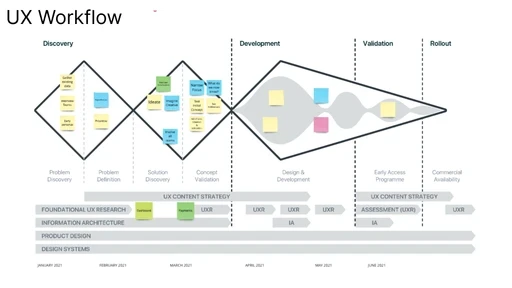

Process

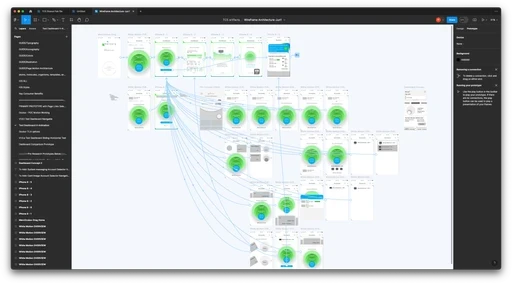

UX Governance & Strategic Alignment

Introduced structured UX governance with defined review cadence and decision checkpoints, reducing rework cycles and aligning cross-functional teams

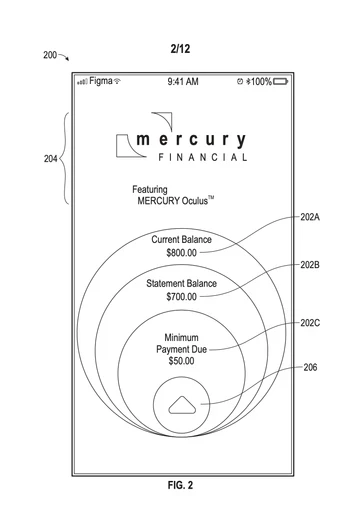

Trust-Centered Payment Architecture

Mapped high-risk payment scenarios (e.g., autopay resistance) and designed visible control mechanisms and transparent transaction states to reduce user apprehension

Cross-Platform System Architecture

Built a unified design system across iOS, Android, and Desktop with formalized component standards and governance, accelerating delivery and consistency

Parallel Validation & Delivery Acceleration

Engaged Projekt202 for simultaneous feasibility and usability validation while partnering with Tata Creative Services to standardize design implementation to recapture momentum

Behavioral Intelligence Integration

Initiated a machine-learning behavioral prompt framework to support contextual credit progression guidance

Outcome

User Impact

Increased App Store rating from 1.0 → 4.9 through improved clarity, control, and trust signalling

Reduced payment-related anxiety by surfacing transaction states and recovery pathways

Strengthened engagement with key features like split pay and onboarding flows

Platform Impact

Delivered unified cross-platform experience across iOS, Android, and Desktop

Established a robust cross-platform design system and governance model

Reduced rework cycles and stabilized product definition ahead of merger

Business Impact

Contributed to platform maturity and acquisition readiness ahead of a $128M merger

Increased internal alignment between product, engineering, and marketing

Elevated brand consistency during critical growth phase

Intellectual Property & Value Architecture

Collaborated with a 25-time technology patent inventor to formalize the platform’s behavioral credit progression model into a filed patent application

Aligned UX architecture and behavioral design systems with defensible IP strategy

Structured core value proposition around scalable, differentiating interaction patterns